Short-term Loan Canada Things To Know Before You Buy

Wiki Article

Excitement About Short-term Loan Canada

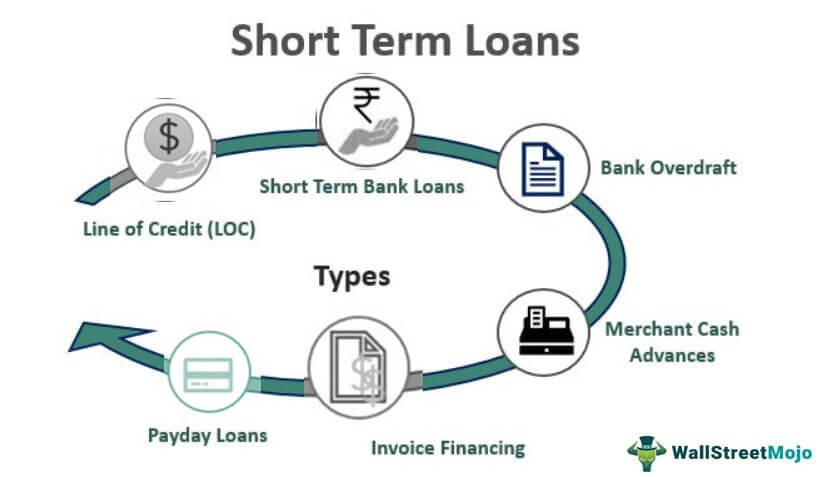

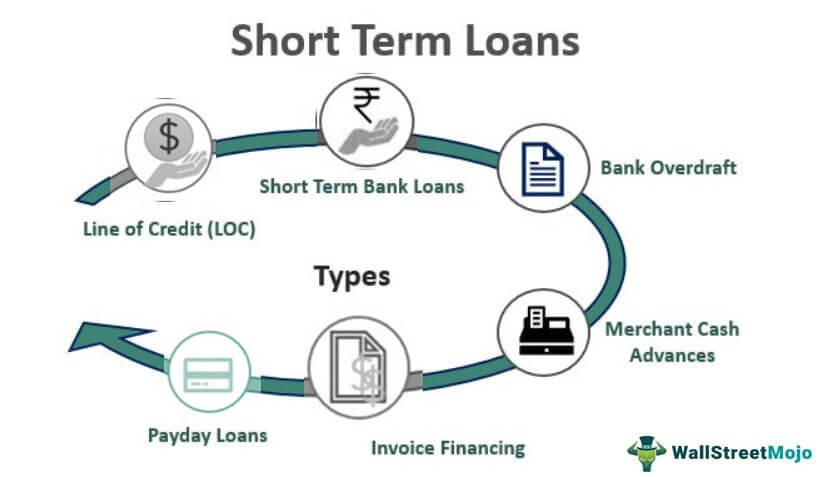

Table of ContentsShort-term Loan Canada Can Be Fun For EveryoneThe Main Principles Of Short-term Loan Canada The 10-Minute Rule for Short-term Loan CanadaThe Buzz on Short-term Loan CanadaNot known Facts About Short-term Loan CanadaThe Short-term Loan Canada PDFs

The calculations and amortization routine created are: (i) based upon the accuracy and completeness of the data you have actually gone into, (ii) based on assumptions that are believed to be affordable, as well as (iii) for estimate objectives only and need to not be trusted for certain monetary or other suggestions. When you make your credit history application, rate of interest might have changed or may be different due to details contained in your application.

They are unprotected loans, meaning that you do not require to secure your financing versus your house or automobile or any kind of other building. If you obtain a temporary funding you are needed to pay off the exact same quantity each month to the lender until the financing and the passion are repaid.

Some Known Factual Statements About Short-term Loan Canada

9% You after that are needed to pay back 178. 23 to the loan provider each month for the next three months. After the three months you will certainly have paid back an overall of 534. 69. It would certainly have cost you 34. 69 to borrow that 500. At Cash money, Girl, we make finding a short-term financing fast and very easy.We then present your application to the 30+ lenders on our panel to locate the lender most likely to approve your application, at the best APR readily available to you. We will then direct you directly to that lenders web site to finish your application. Our service is free and also thanks to our soft search technology has no influence on your credit report.

By comparison, a short-term car loan is spread out over 2 or even more months. For several individuals, spreading out the expense over a number of months makes the loan payments much more affordable.

What Does Short-term Loan Canada Do?

The Basic Principles Of Short-term Loan Canada

If you are contrasting lendings online, you might find that the rate of interest on brief term finance products look high when contrasted to heading lending rates marketed by high road financial institutions or constructing cultures. One essential reason for this is that short-term lending institutions accommodate lending to those with poor credit report accounts or no credit rating history in any way.This threat is passed on to the customers in the kind of a higher rates our website of interest. If you fall short to satisfy your payments then yes, your credit history score can be negatively impacted. Although this holds true of any kind of loan or credit history item, not just temporary loans. On the other hand, if you fulfill all your repayments in full and also on time after that this might show that you can be relied on to take care of credit scores well and also might enhance your credit report score.

If you fulfill all these requirements, then yes you are eligible to use. If you are having problem with your financial resources and also stressed about your debts then there are a number of organisations that you can transform to totally free and objective advice. See the web links listed below.

Short-term Loan Canada Fundamentals Explained

Payday advance loan are temporary finances of up to $1,500 supplied for a post-dated paycheque or other pre-authorized debit that the lender uses for future payment of the car loan, plus any rate of interest and fees. If the payday advance is not settled on time, it can lead to even more interest and also charges. short-term loan canada.As an example, if you borrow $500 for a cash advance, you can be charged up to $75 in rate of interest and fees. This might not appear like a great deal of money, yet the short duration of a cash advance indicates they have much higher passion costs than other sorts of finances.

Let's determine what a cash advance might cost you. Claim that: The amount of your following paycheque will be $1,000 You want to secure a payday advance loan for $300 The cost to borrow the loan is $45 The complete cost to settle the finance is $345. That implies the amount you will certainly receive from your following paycheque will certainly be $655.

The Best Guide To Short-term Loan Canada

Cash advance loan providers are controlled in B.C., indicating any kind of firm that provides cash advance lendings have to be accredited and also adhere to laws established by the rural federal government. You can examine to see if a firm is certified with this. Business should also show the licence wherever it provides payday finances, whether online or in-person.If you have inquiries or interest in a payday lending or lending institution, contact Customer Defense BC.

If high rising cost of living is pressing your budget, you aren't alone. A current study by Finder found that 36 percent of Canadian consumers stated their main factor for securing a loan is to cover expenses for rent, home mortgage, food and also transport. navigate to these guys With rising cost of living at 7. 6 percent, many Canadians are relying on financings to spend for requirements.

Report this wiki page